can you work part time and collect social security disability

Social Security generally finds a person to be disabled if they cannot sustain full-time work on a regular basis. You cannot report a change of earnings online.

Is Ssi The Same As Social Security Disability As Usa

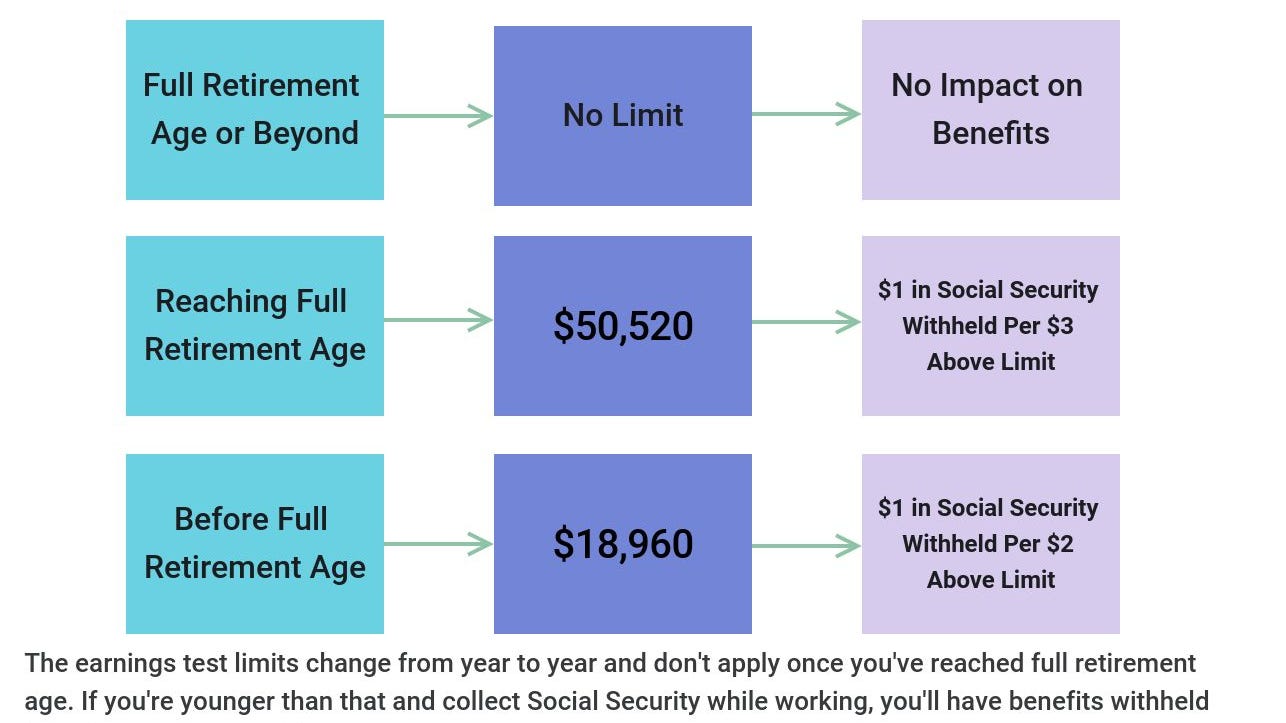

The earnings limits are adjusted annually for national wage trends.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

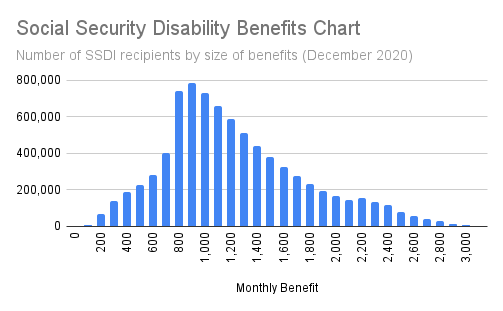

. One answer responds to both questions. The SGA for 2018 is set at. Payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind.

Can You Work Part-Time on Social Security Disability. But if your regular work before applying for disability was part-time work and Social Security finds you can still do this work your claim can be denied. Yes you can work part-time on Social Security Disability as long as your income does not exceed the allowable income limits set by the Social Security Administration SSA.

Youll be eligible to earn. Also known as Supplemental Security Income SSI you can receive Social Security retirement benefits as long as youre at least 62 years old and have at least 40 work credits. The SSAs income limits let you earn up to 1260 per month or 2110 per month if you are blind and still receive your full disability benefits.

The short answer is yes. If you have questions about working on Social Security Disability benefits call Berger and Green at 412 661-1400 for a free case review. Does your medical condition prevent you from working.

Your benefits will typically be reduced by approximately half. You lose 1 in benefits for every 2 earned over the cap. Based on this you would think that working part-time while collecting SSDI benefits would be a definite no-no But surprisingly thats not the case.

If You Go Back to Work Publications Your Continuing Eligibility In most cases you will continue to receive benefits as long as you have a disability. Qualification Qualification for SSDI benefits is based on your work history with a certain amount of time covered by your employer based on when you paid Social Security taxes. But in some cases you may take part in work incentives while receiving the full amount of SSDI.

En español Yes within strict limits. Social Security Disability Insurance SSDI payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2020 as earning more than 1260 a month or 2110 if you are blind. If youre working part-time and are earning more than the maximum amount per month set by the SSA then your eligibility for SS disability benefits could be in jeopardy.

In 2020 you lose 1 in benefits for every 2 earned over 18240. See our article on partial disability and part-time work. However there are certain circumstances that may change your continuing eligibility for disability benefits.

Work credits are earned when you pay Social Security taxes on income you earned from a job or from self-employment. You work and earn 29560 10000 over the 19560 limit during the year. The trick is theres a limit.

Suppose you will reach full retirement age in 2022. For example your health may improve or you might go back to work. The SSA defines Substantial Gainful Activity SGA as any monthly earnings over 1260 except for those who receive disability for vision problems.

In this case you can continue working part-time on disability while collecting full benefits as long as your earnings are not considered by the SSA to be substantial. Your Social Security benefits would be reduced by 5000 1 for every 2 you earned over the limit. Receive Social Security disability If you receive Social Security because of a disability you or your representative must tell us right away if any of the following occur.

People receiving Social Security disability benefits can work part-time and still receive their monthly payments. You can retire collect Social Security still work and be productive. 1180 per month for non-blind applicants.

Updated February 2 2022. Social Security and Disability Eligibility. Please call us at 1-800-772-1213 TTY 1-800-325-0778 800 am 700 pm Monday through Friday or contact your local Social Security.

However if the work performed before submitting an application for disability was only done on a part-time basis and Social Security believes you can still perform this type of work they may deny your claim. So if you have a part-time job that pays 25000 a year 5440 over the limit Social Security will deduct 2720 in benefits. Many people receiving disability benefits ask the same question to their Pennsylvania SSDI attorney.

The short answer is yes. Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. You would receive 4600 of your 9600 in benefits for the year.

Social Security Work Incentives You May Receive. The Social Security Administrations Ticket to Work program and work incentives can help people work while receiving Social Security Disability Insurance SSDI or Supplemental Security Income SSI benefits. How much can I earn in 2020 and still collect Social Security.

If you are receiving benefits from the social security disability insurance SSDI you can work part-time within a trial work period with the SGA limit still in place. If youre earning more than the set maximum shown above before. So yes you can work while on social security disability.

However there are strict limits as to how much you can work and earn while getting Social Security Disability Insurance SSDI. In that case the earnings limit is 51960 with 1 in benefits withheld for every 3 earned over the limit. This Trial work period comprises of 9 months which after that the SSDI will discontinue your disability benefits if you continue working.

For example in 2022 you cannot make more than 1350 a month gross and still. You can work part time while on Social Security Disability. Medical Eligibility Disability benefits via Social Security are based on your ability to work.

Ad Social Security Disability Insurance Stops If You Earn More Than Certain Monthly Limits. 1970 per month for blind applicants. Once you reach FRA there is no cap on how much you can earn and still receive your full Social Security benefit.

If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us let us know right away. Will I lose my SSDI if I work part time. Unfortunately there are some drawbacks to working part-time while on disability.

You need to earn a living while you are waiting to get approved for disability benefits though it may not always be in your favor to work during the approvals process. Are You Taking Part in One of Social Securitys Work Incentives Programs. Generally Social Security will find you disabled if you cant sustain full-time work on a regular basis.

If you become disabled at the age of 52 you need 30 work credits. While there are certain exceptions your monthly SSDI benefits will be reduced by your monthly income. The SSA wants you to work so the amount of benefits they have to pay out is reduced.

It is possible to receive Social Security disability benefits if you are working part-time. You just have to make sure your income doesnt exceed. The Social Security Administration wants to help individuals who need assistance due to a disability but still wish to work.

They want to know if they can work on a part-time basis and collect SSDI benefits at the same time. 9600 - 5000 4600 Reach full retirement age in August 2022.

How Long Term Disability Works With Social Security Disability Cck Law

Work Comp Audit Can You Collect Both Worker S Comp And Social Secu Social Security Benefits Social Security Disability Benefits Social Security Disability

How To Get The Maximum Social Security Benefit Smartasset

Alzheimer S Disease And Social Security Benefits Alzheimer S Dementia Resource Center

Cola When Will The First Social Security Benefit Checks Arrive In 2022 As Usa

How To Get Social Security Benefits If You Ve Never Worked A Day In Your Life The Motley Fool

How Are Social Security Disability Benefits Calculated

How Social Security Benefits Are Calculated

What Are The 2021 Social Security Earnings Test Limits

8 Things Everyone Wants To Know About Social Security Becu

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

How Long Do I Have To Work To Qualify For Ssdi

A Note To Those Who Think Receiving Disability Benefits Means I Have It Easy

What Are Social Security Credits

8 Things Everyone Wants To Know About Social Security Becu

Social Security Types Payouts The Program S Future

Pros And Cons Of Receiving Social Security

How Much In Social Security Disability Benefits Can You Get Disabilitysecrets